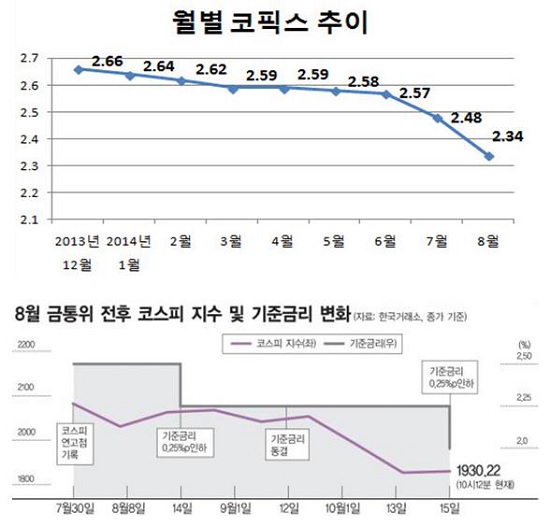

There was an expectation that the interest rate on mortgage loans would be more than 8 percent, but expectations are growing that the U.S. central bank, the Federal Reserve System, will adjust the rate of increase and domestic interest rates will be adjusted.However, it is true that the Bank of Korea has already carried out big steps and baby steps in a row, and the market interest rate has risen even higher.The burden of interest on borrowers who have recently converted to variable interest rates has more than doubled over the past five years, making it difficult to repay interest as well as principal.

Currently, interest on mortgage loans is paid through a fixed interest rate system, but there is little concern about borrowers who will be converted to a variable interest rate system in the future.Although the Bank of Korea recently carried out baby steps in a reasonable way as part of a plan to adjust market interest rates, experts in the financial sector predict that the benchmark interest rate will rise further early next year.However, there was an opportunity to switch to a fixed rate of at least 3.7 percent through a safe conversion loan similar to a home mortgage loan, so I think those with qualifications recently accepted the application.

In the case of safe conversion loans, more than four conditions were accepted within 25 days after the second stage of acceptance.According to statistics released by the Korea Housing Finance Corporation, more than 30,000 applications were received through smart housing finance apps and the homepage of the Korea Housing Finance Corporation, and more than 30,000 applications were submitted through the windows of the six major banks.Until October 31st, the first application was accepted under relatively tight conditions, but in the case of the second application, the standard for housing prices was reduced to 600 million won, and the combined income of couples increased to 100 million won.

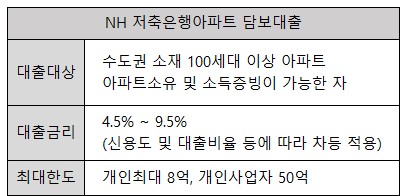

The loan limit has also increased to 360 million, so more people can benefit from it, but people in blind spots may find it difficult to even benefit from it.If the government does not benefit from the system provided by the government.The next best way is to investigate the rate of mortgage loans in various ways.In the case of Kakao Bank, which belongs to an Internet bank, the balance exceeded 1 trillion won within 10 months of the release of mortgage loans.

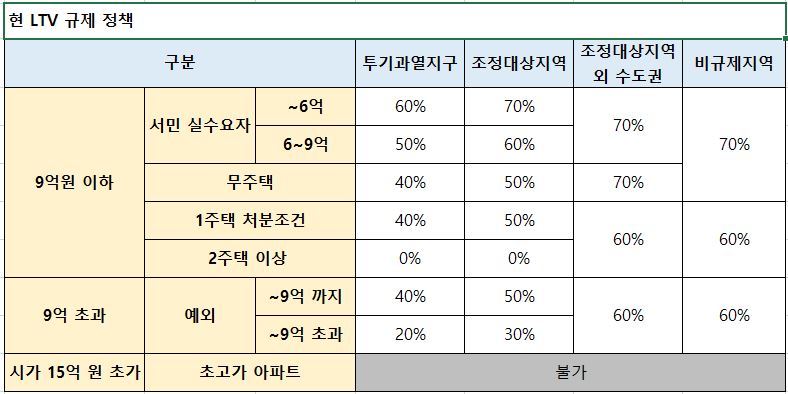

The product was released in February, and the target area has expanded since August, and it takes only about three minutes on average to check the limit of the amount and interest rate that can be lent.Not only is it relatively convenient to use, but it also has the advantage of free prepayment fees.In addition to this, I will introduce the benefits that Shinhan Bank is giving to reduce the interest rate on apartment mortgages even a little and to compare and analyze the ltvdti limit more reasonably.Shinhan Bank has implemented a program to suspend interest on loans to ease the burden of interest on borrowers during a period of rising interest rates.

However, there are qualification requirements, so you need to look into them in detail.Even among borrowers who received mortgage loans through the principal-based repayment method, the balance of the loan is more than 100 million won, and COFIX benefits more than 0.5 percent of Sangsu borrowers.If there is a change in COFIX or transaction performance within a year, the loan interest rate may change, but it is better to consult directly at the customer center or sales store for detailed conditions.I heard that you can apply through Shinhan Bank’s app, which will be released soon, so it would be good to get a consultation to check the qualification conditions in advance.

Next year, the government plans to voluntarily release and implement the special housing mortgage theory, Bogumjari Lone.It’s good information to refer to when you buy a house, but there are predictions that you won’t get a good response in the real market where real estate transactions are frozen and housing prices are falling.If you tell us about the benefits you can enjoy through the special Bogumjari loan, it is a loan product that allows you to get up to 500 million won at a fixed rate of 4-5% per year when you buy a house with a market price of less than 900 million won.It will be temporarily operated for a year, and unlike the existing residential mosquito theory, the entry barrier is low, so there is a prospect that many people will be able to meet the qualification requirements.

It is said that the special Bogumjari-Rone will have a system available not only to those who want to buy new houses, but also to borrowers who have already received apartment collateral loans with variable interest rates.Furthermore, you can use it even if you have the purpose of returning the lease deposit to the secured property, so please refer to it if applicable.There are many benefits programs run by the government and banks, but people in blind spots can see that finding lending products that they can use is the most realistic solution.

I would like to finish by simply presenting a way to reduce the rate of apartment mortgage loans even a little and increase the rate of ltv and dti even a little.If you download an application called Dambi, you can compare not only housing prices but also various banking mortgage products and credit products at a glance.It can be used effectively not only for those who want to take out loans, but also for those who are interested in buying and selling houses.If you are not used to using the app, please feel free to consult with us.https://abr.ge/q7ytkg

Easy and easy loan comparison platform abr.ge

Easy and easy loan comparison platform abr.ge